Investing in cannabis stocks today is like voting for the political party of your choice.

Excluding up-front money considerations, of course.

Because, a wise man, a very wise man, once said –

“In the short run, the markets are a voting machine, while in the long-run, they’re weighing machines.”

Or something along those lines.

What Benjamin Graham meant, Warren Buffet’s mentor, is that within shorter time-periods, beliefs and opinions rule the market. While, in longer time frames, actual measurable and tangible economic results do.

Today, in the context of cryptocurrency tech disruption and cannabis legalization, this phrase couldn’t be more relevant.

And, if you’re a long-term cannabis stockholder, your returns couldn’t also have been more higher.

So, whether cannabis markets today are fuelled by speculation, or economic results, a voting or weighing machine, those interested are still confronted with the question –

Is there still money to be made investing in cannabis stocks today?

In this article, we’ll help you come to the right decision, by focusing on the major events – starting with Canadian legalization – that are behind the new highs for cannabis stock prices.

Take a deep breath and brace yourself.

Or, take a few big hits on us.

June 21st – Canada Makes a Bold First Move

Bill-C45, the Cannabis Act, is passed, with plans to legalize recreational marijuana on October 17th.

Canada then becomes the first G7 nation, that is, the only advanced economy out of the highest 7, to legalize marijuana in one form or another nationally. They’re also only the second country in the world, before Uruguay.

One big step for Canada. One giant step for cannabis legalization.

But, one step backwards for marijuana stocks.

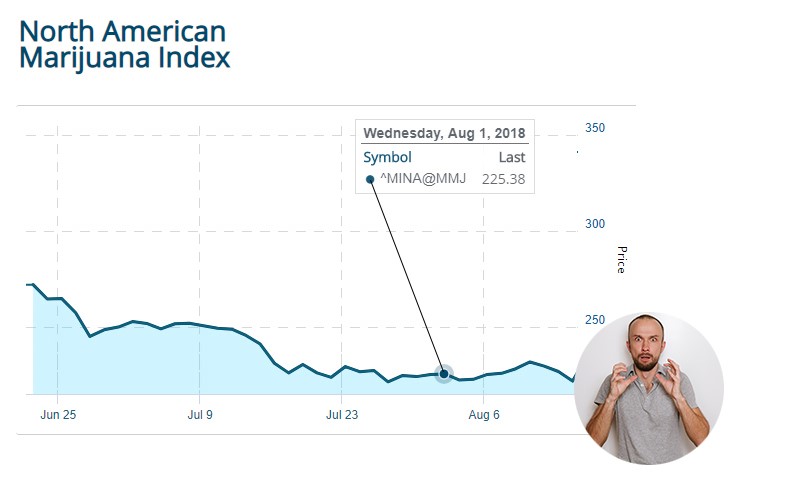

Instantly following the news, prices declined until the beginning of August. Below is a price chart for the North American Marijuana Index, a collection of the 35 most valuable cannabis firms.

However, the implications of recreational legalization are so very much more.

Even if they’re not reflected in the stock market, for the time being.

Because, behind fluctuating stock prices, behind breakthrough actions of Canadian law, and behind slowly changing stigmas of marijuana use – legalization created an entire market.

Well actually, such a market always existed. But following legalization, its thorny electroconvulsive illegal-like floodgates were open for immense capitalistic opportunity.

Corporations say hello.

August 1st – Hey! This Drink is the Chronic

“Want a Molson Canadian beer? No?”

“How about this Molson Canadian cannabis infused drink?”

Beery brewery giant, Molson Coors, decides to be the first to put its big MillerCoors drenched footprint in the Canadian Cannabis market.

Publicly, on August 1st, they announced a partnership with Canadian cannabis firm Hydropothecary Corporation to produce and sell non-alcoholic cannabis infused beverages.

However, financials about the deal weren’t disclosed.

Along with this, consumables of any cannabis kind aren’t legal in Canada until October of 2019, leaving many investors to hesitate whether its potential economic benefits are immediate enough to push stocks higher.

So, the news barely shakes the stock market. However, it does keep stocks from reaching new lows, thus putting a stop to declining prices.

Shown below is the effect.

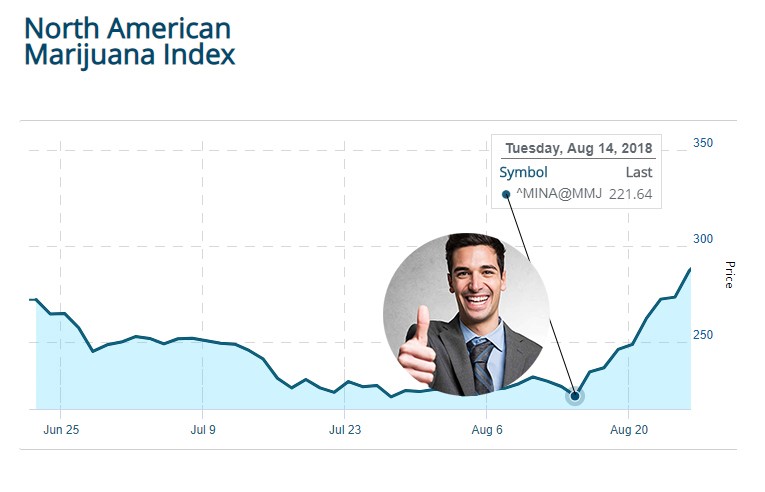

August 15th – Canopy Growth Becomes Just Another Constellation Brand

The company that’s responsible for Corona beers and Robert Mondavi wines, amid many others, decides investing 5 billion big ones into Canopy Growth, Canada’s largest licensed producer.

They didn’t have their discount shopping hats on either.

Because, Constellation Brands, the name of the company, invested the 5 billion by purchasing over 100 million shares of Canopy at 50% more than its stock price.

As you can imagine, this result sent positive shockwaves for marijuana stocks, mainly for three reasons:

- Financials were somewhat disclosed, given by the premium paid by Constellation Brands.

- Constellation Brands also released a rough analysis, detailing the Cannabis market’s potential size and opportunity. Not just for Canada, but for the entire world.

- Cannabis investors are speculative-fuelled freaks. In the most loving way 😊.

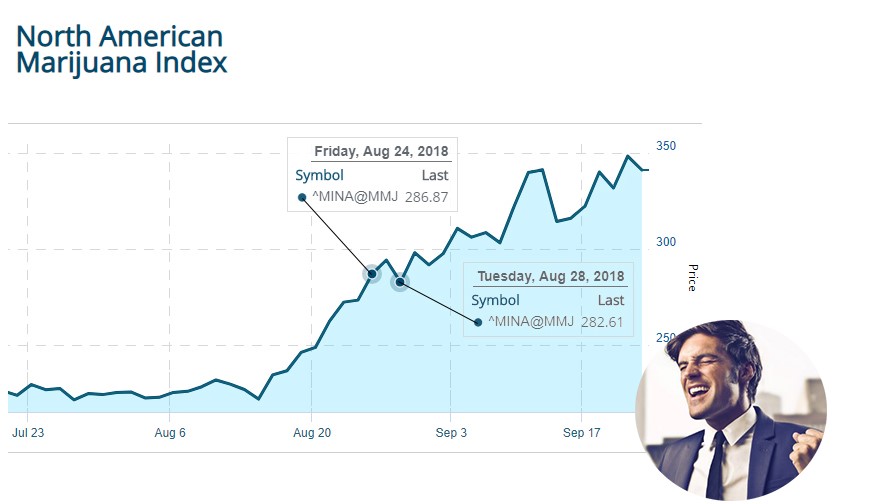

August 24th – Another Alcohol Company? What Gives?

Notice a trend?

Molson Coors and Constellation Brands are both giants in the alcohol industry, and given recent news, they have plans to be giants in the cannabis space as well.

Not surprisingly, an even bigger player, Diageo Plc, the Crown Royal, Johnnie Walker and Captain Morgan producer, is reportedly doing the same.

On August 24th, BNN Bloomberg releases a timely report, declaring that Diageo Plc is in serious partnership talks with at least 3 major Canadian cannabis producers.

Speculative questions suddenly arose for investors:

Which company? And could another premium be paid, like the Canopy Growth – Constellation deal?

The answers are still unknown, yet one thing’s for sure: such questions served as a launching pad for cannabis stocks, as they reached new highs.

Also, if your wondering why alcohol companies are making such an aggressive push into the cannabis space, its because they’re in protection mode. You see, cannabis sales are expected to snatch a whole lot of market share from alcohol sales, not to mention the pharmaceutical industry as well. But that’s a topic for another article.

August 28 – Alcohol and Cannabis: Honeymoon Phase. How Sweet it is.

Simply, more news sends cannabis stocks even higher.

Even more companies, not just any number of companies, but some of the world’s largest beverage players, both alcoholic and not, are reported to being in serious talks with several licensed cannabis producers.

The Globe and Mail released an article on August 28th (rephrased):

The folks behind Budweiser, Anheuser-Busch InBev, the world’s largest beer brewer is one of them. Another is Absolute Vodka’s Pernod Ricard, the world’s second largest spirits maker behind Diageo Plc. Add Heineken Holdings, with there 200 and counting beer brands to the mix. And finally, Coca-Cola, as we all know, the world’s largest non-alcoholic beverage producer. All admitted to being in negotiations.

Large is probably an understatement by the way, because we’re not speaking in the sense of awareness or staff employed, although all enormous in that regard – but large in terms of revenue generated.

Large just might be an understatement.

As for cannabis stocks:

Speculative questions of who, how much and when from cannabis investors further sound off. And, higher cannabis stocks go.

Is There Still Money to be Made with Canadian Cannabis Stocks Today?

Of course, there is. But, there’s also just as much to lose, given investing in the stock market is a zero-sum game – meaning, for every winner there must be just as many losers.

As for our role, we’ve provided half the battle, that is, an update on what’s unfolding in the cannabis space and how its affected cannabis stocks as of late.

But, to determine whether if the space is still truly worth investing today, we’d advise looking further into:

- Valuation techniques

- Trading techniques such as momentum trading and technical analysis

- Boom and Bust Cycles

- Benjamin Graham’s definition of enterprise and defensive investing

Don’t be surprised if we cover any of the following topics soon, so look out.

Happy researching and thanks for reading. Feel free to leave any comments below.

Cheers.